Vietnam ATM : Finding Cash & Avoiding Fees

huyhai

huyhai When you’re traveling abroad, having access to cash is often necessary, and Vietnam is no exception. Whether you’re exploring the vibrant streets of Hanoi, shopping in Ho Chi Minh City, or relaxing on the beaches of Da Nang, knowing how to withdraw cash easily and avoid unnecessary fees can make your trip more convenient and cost-effective. Fortunately, Vietnam has an extensive network of ATMs, making it simple for international travelers to access cash. In this guide, we’ll provide all the information you need about ATMs in Vietnam, how to find them, how to withdraw money, and how to avoid ATM fees while ensuring your safety.

1. The Basics of Using ATMs in Vietnam

Vietnam’s ATM network is widespread, with ATMs available in most urban centers, tourist areas, and even in some rural locations. While ATMs in Vietnam are mostly used to withdraw Vietnamese Dong (VND), the local currency, some ATMs allow you to withdraw US Dollars (USD), though this is less common. Understanding how ATMs work in Vietnam can save you time and money during your travels.

1.1. Types of Cards Accepted at Vietnamese ATMs

ATMs in Vietnam are compatible with major international bank card networks like Visa, MasterCard, Cirrus, and Plus. If you’re using a debit or credit card issued by an international bank, you should have no trouble withdrawing cash at most ATMs in the country. However, not all ATMs are capable of processing foreign cards, so it’s important to look for ATMs that display the Visa, MasterCard, or Cirrus logo.

👉 Tip: It’s always a good idea to inform your bank of your travel plans before departing. This will help ensure that your cards work properly while you’re abroad and prevent them from being blocked for suspected fraudulent activity.

💻 You can read more: Vietnam Digital Payments : A Guide for Tourists

1.2. How to Find an ATM in Vietnam

ATMs are widely available in urban areas and tourist destinations. In major cities such as Hanoi, Ho Chi Minh City, Hoi An and Da Nang, you will easily find ATMs in commercial centers, supermarkets, banks and even in large shopping malls. In particular, in these areas, most ATMs support international cards, so you will not have difficulty withdrawing money.

👉 Popular Areas with ATMs

Hanoi: Areas around Hoan Kiem Lake, the Old Quarter and large shopping malls such as Vincom, Lotte Center.

Ho Chi Minh City: District 1, areas near Ben Thanh Market, Nguyen Hue walking street and large shopping malls such as Takashimaya, Saigon Center.

Da Nang: Downtown areas and coastal areas such as My Khe and Ba Na Hills.

If you are traveling in rural or less developed areas, finding an ATM may be more difficult, so it is best to have cash ready before going to these places.

❤️ Explore Tour: Vietnam Family Holidays 14 Days

2. How to Withdraw Money from ATMs in Vietnam

Withdrawing money from an ATM in Vietnam is relatively simple. Follow these basic steps to ensure a smooth transaction:

Step 1: Locate an ATM

ATMs are easy to find in Vietnam, especially in major cities like Hanoi, Ho Chi Minh City, and Da Nang. Many ATMs are located near banks, shopping malls, hotels, or tourist areas. You will also find ATMs in convenience stores, shopping centers, and transport hubs like airports and bus stations.

👉 Tip: While ATMs in tourist-heavy areas are abundant, always be cautious of ATMs located in isolated areas. Stick to ATMs located in well-lit, busy places, such as inside banks or malls, for extra security.

Step 2: Insert Your Card and Choose the Language

Once you’ve located a suitable ATM, insert your card into the machine. Most ATMs in Vietnam will ask you to choose a language before proceeding. English is usually an option, so select it for easy navigation.

Step 3: Enter Your PIN

After selecting your language, the ATM will prompt you to enter your PIN (Personal Identification Number). Make sure to cover the keypad while entering your PIN to protect your privacy. The ATM will then show you a list of transaction options.

Step 4: Select the Amount to Withdraw

Once your PIN is accepted, the ATM will ask how much money you want to withdraw. The amounts will typically be listed in Vietnamese Dong (VND). Make sure to choose an amount within your daily withdrawal limit, as some ATMs may have restrictions on the maximum withdrawal.

👉 Tip: It’s always a good idea to withdraw larger sums of money at once rather than making multiple withdrawals. This can help you avoid extra fees and save time, especially if you’re in a less busy area with fewer ATMs.

Step 5: Confirm the Transaction and Collect Your Cash

After selecting the amount to withdraw, the ATM will show a confirmation screen. Review the details and confirm the transaction. The machine will then dispense your cash along with a receipt. Don’t forget to take both your card and receipt before leaving.

💻 You can read more: Using Vietnam Mobile Wallets

3. ATM Fees in Vietnam

While using ATMs in Vietnam is generally a straightforward process, one important consideration for travelers is the fees associated with withdrawals. There are two types of fees to be aware of:

3.1. Foreign Card Fees

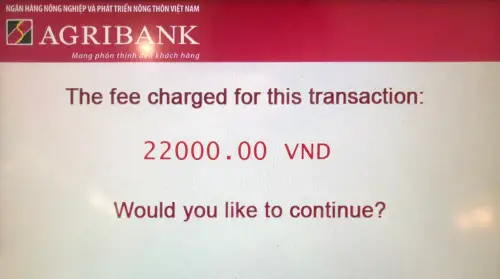

Most international banks charge a foreign card fee for withdrawals made outside your home country. These fees vary by bank, but they typically range from 2% to 3% of the amount withdrawn. Additionally, some ATMs in Vietnam may charge a small fee (usually around 20,000 VND to 50,000 VND) per transaction for using a foreign card.

👉 Tip: To minimize foreign card fees, try to use ATMs that are operated by well-known banks or those that display major card logos like Visa or MasterCard. (or more information in here: Vietnam Payment Hacks: 10 Insider Tricks for Foreigners)

3.2. ATM Withdrawal Fees in Vietnam

In addition to foreign card fees, Vietnamese ATMs may charge their own transaction fees for withdrawing money. These fees are typically lower than international bank fees but can still add up over time. ATM withdrawal fees in Vietnam usually range between 20,000 VND and 50,000 VND per transaction.

To avoid unnecessary fees, always check the withdrawal limits and fees before proceeding. Some banks offer ATM networks with lower or no withdrawal fees for international cardholders, so it’s worth doing a little research before choosing where to withdraw money.

👉 Tip: Look for ATMs operated by major Vietnamese banks, such as Vietcombank, BIDV, or Agribank, as they tend to have fewer additional charges for foreign card users.

🌟 If you need or want to explore some tours to Vietnam, you can explore some Vietnam tours below or contact us via WhatsApp or visit the Sun Getaways Travel Fanpage.

4. How to Avoid High ATM Fees in Vietnam

While ATM fees in Vietnam are generally low, it’s still possible to minimize the cost of withdrawing cash. Here are a few strategies to help you avoid high ATM fees while in Vietnam:

👉Use ATMs with Lower Fees

As mentioned earlier, ATMs operated by well-known local banks, such as Vietcombank, Agribank, or BIDV, often have lower withdrawal fees than independent ATMs or those in tourist-heavy areas. Stick to these banks whenever possible to minimize costs.

👉Take Out Larger Amounts

Withdrawing larger amounts at once can help you save money in the long run. Since most ATMs charge a flat transaction fee, withdrawing a larger sum at once means you’ll pay the same fee but access more cash.

👉Use a Credit or Debit Card with No Foreign Fees

Some international banks and financial institutions offer credit or debit cards with no foreign transaction fees. If you have such a card, it can save you from both foreign card fees and ATM withdrawal charges. Look into your bank’s offerings before traveling to Vietnam.

👉Avoid Using ATMs in Remote Areas

ATMs located in tourist-heavy or isolated areas may have higher fees to compensate for the lower volume of users. Whenever possible, try to use ATMs in more central, well-populated areas such as shopping malls or bank branches.

💻 You can read more: Paying with QR Codes in Vietnam: A Quick & Easy Guide

5. Safety Tips for Using ATMs in Vietnam

While ATMs in Vietnam are generally safe, it’s always important to stay vigilant when withdrawing cash, especially in unfamiliar locations. Here are a few safety tips to keep in mind:

- 📍Use ATMs in Busy Areas: Stick to ATMs located in well-lit, high-traffic areas, such as inside banks, shopping malls, or large hotels.

- 📍Cover Your PIN: Always shield the keypad when entering your PIN to prevent others from seeing it.

- 📍Check for Skimming Devices: Before using an ATM, check for any suspicious devices that could be used to capture your card details, such as extra card readers or cameras.

- 📍Withdraw During Daylight Hours: If possible, make your withdrawals during the day to reduce the risk of theft or scams.

- 📍Report Lost or Stolen Cards Immediately: If your card is lost or stolen, contact your bank immediately to block it and prevent unauthorized transactions.

💻 You can read more: Staying Safe Online in Vietnam: VPN, Cybersecurity & Data Protection

6. Conclusion

Accessing cash in Vietnam through ATMs is a straightforward and convenient process. With the right precautions, you can avoid unnecessary fees and ensure a smooth experience. By using local ATMs with lower fees, withdrawing larger sums of money when possible, and staying vigilant about safety, you’ll have no trouble managing your finances during your trip to Vietnam.

Remember to choose your ATMs carefully, check for language options, and plan your withdrawals wisely to make the most of your trip without worrying about high ATM fees in Vietnam.

👉 More information in here: The Ultimate Foreigner’s Guide to Payments in Vietnam: 10 Chapters

Ask a question

Leave a Comment (0)

No questions yet. Be the first to ask a question!